The automobile industry has played a prominent role in the economies of many countries of the world. It has served as an economic power throughout its more than 100-year history. The industry employs millions of workers and has billions of dollars in capital that are being invested in the name of improving individual mobility.

In many countries from Japan to Germany, the companies behind this driving force have become household names. A person’s choice of car became as much a part of their identity as the clothes they wore.

However, Many industries have faltered somewhat over the past year and a half, especially the automobile industry. The emergence of the pandemic marked the beginning of what turned out to be one of the most challenging periods in the history of the industry. Downsizing, strategic rethinking, weak demand and supply chain issues have hampered production and hurt corporate stock prices. At least for traditional automakers.

The lack of access to semiconductors that are used in all phases of modern automobile production, from braking systems to satellite navigation, has forced Auto companies have disrupted their production lines and their goals have declined. The effect is likely to be good next year.

In the midst of this chaos, Traditional car manufacturers such as Ford or Toyota have been threatened by the trend of investing in electric car stocks, as local electric vehicle (EV) companies such as Tesla, Rivian and NIO in China have become a favorite of many. Although their fundamentals fail to match those of traditional companies.

Auto stocks have experienced a drastic change in recent years. The largest companies in terms of revenue are no longer necessarily the largest in terms of market capitalization. Investors are moving in droves to invest in auto companies that are more prepared for the upcoming electric car future.

The transition to electric cars must come with environmentally friendly energy generation

At the 2022 United Nations Climate Change Conference held at the beginning of November, More than 20 countries, several cities, states and selected auto manufacturers have signed a document to work on selling new zero-emissions cars by 2040.

Although many agree to switch to zero-emissions electric cars, the harsh reality that many must understand is that the use of electric cars will not guarantee low carbon emissions due to Asia’s dependence on fossil fuels for energy production.

That is why there must be pressure from countries to speed up the transition to using “green” electricity first, before moving to “green” cars. According to recent data, nearly 80% of China’s energy supply depends on coal and oil. Coal alone contributes about 60% of the country’s energy production. While other Asian countries such as Vietnam, Hong Kong, Taiwan and India rely heavily on the world’s cheapest fuel, coal, for their energy supply.

In fact, we need to make the switch to cleaner fuels in a smarter way so that it is sustainable, It makes no sense to rush and then go backwards, as we see in China, which has seen a rollback of its carbon-neutral goals after suffering from a severe energy crisis due to a shortage of coal. Even in the United Kingdom, Because of the severe energy crisis then they are restoring their additional coal production.

The main electric vehicle markets represented by China, the United States and Europe are expected to witness stable sales by 2032, In the markets of Asia and the rest of the world we may see a drastic change in the rates of demand.

The electric vehicle sector is likely to play a larger role in Asian economies as governments take tougher stances on reducing carbon emissions.

The shortage of semiconductor chips still poses risks

There are many risks to the electric car industry that can be broken down based on whether the company is a traditional manufacturer that will face a complex and costly transition away from ICE cars or a modern company focused on electric cars.

However, In general, all companies in the market are equally affected by the persistent shortage of semiconductor chips and the shortage of other products in the global supply. Which negatively affected production levels across the industry.

One market analyst says that while supply pressures are set to ease, The shortage is likely to continue to affect the market in 2022. Many experts predict that the shortage will continue to occur somewhat for the rest of this year and possibly even next.

Although it, However, there is some optimism, especially after the statement of Taiwan Semiconductor Corporation (TSMC), Which indicated that it aims to increase the production of its units of microchips by nearly 60% on an annual basis this year, Which eased some of the pressures of the show during the rest of the year and next.

We also note that the impact of chip shortages is uneven across car manufacturers, Where we find that a company seeks to manage the situation in its own way, and, most importantly, Prioritize the production of higher-margin models to minimize the impact on profitability, which, Given the strong consumer demand mentioned above it should be less affected by volume production.

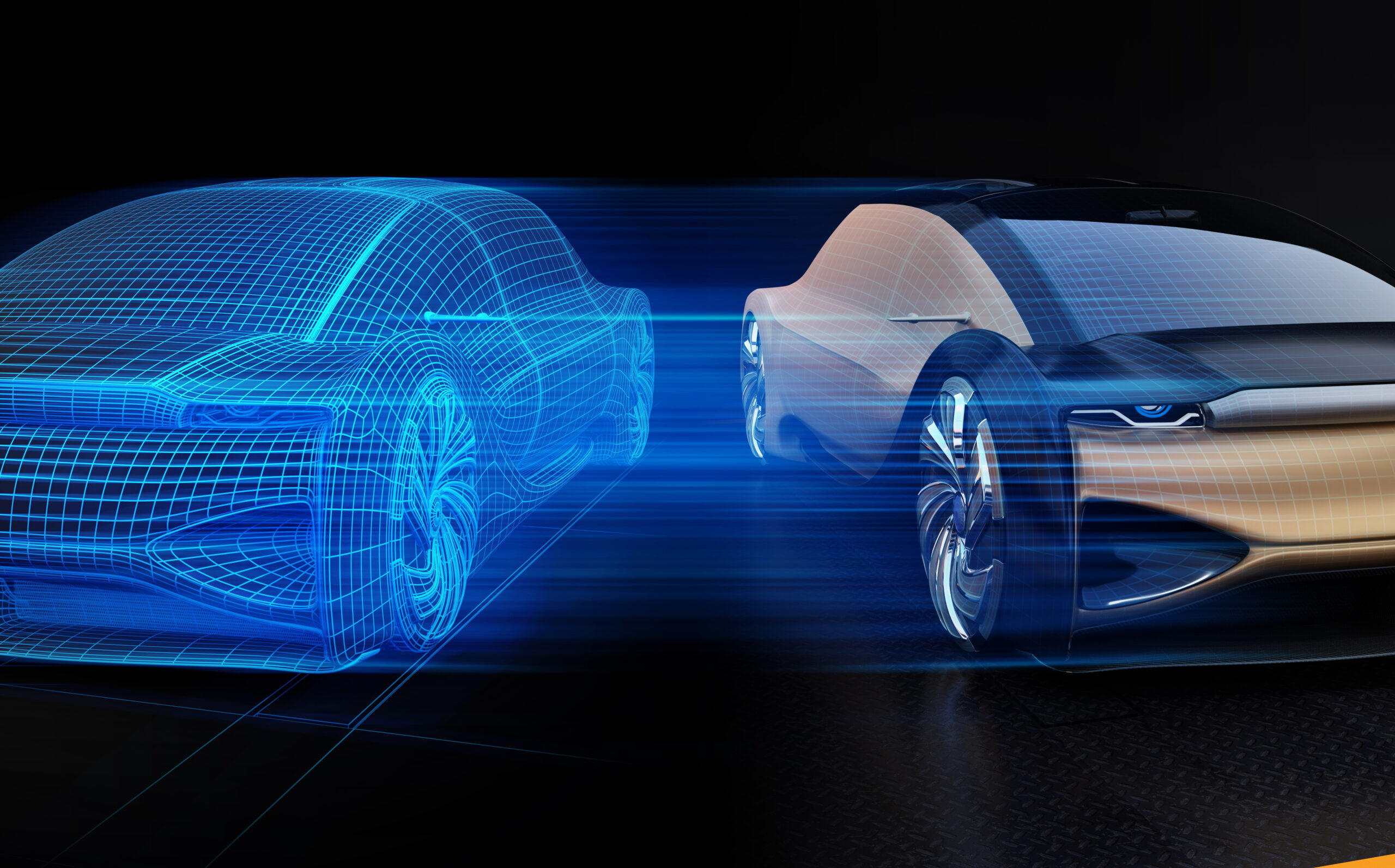

Switching to electricity

For the conventional automobile sector , Another major risk facing senior executives is the threat that domestic electric vehicle companies such as Tesla will become the dominant force in the industry as more consumers switch to electric vehicles.

At the beginning of 2010 electric cars were still considered a long-term opportunity for mass production and adoption. The energy density and efficiency of electric batteries lag far behind that of gasoline-powered vehicles.

However, The electric car industry advanced rapidly until 2022 came. Tesla, owned by Elon Musk, has become the largest electric car company in the world by market value. which was recently recognized as the first company in the sector to have a valuation of over $1 trillion amid frenetic growth and investor support over the past few years.

The company now has a rating of more than five times that of its closest competitor, Toyota. Although it, The Japanese brand “Toyota” is still doubling its revenues before Musk’s company.

at the same time, Electric truck maker Rivian received a valuation of more than $100 billion in its initial public offering (IPO), Although it has not yet released a single official product for the mass market.

Electrification is set to be the dominant factor in the auto industry in the next decade. More manufacturers are making electric cars the majority (if not all) of their product range.