In this article we will know how to buy phone without credit card? It can be a beneficial option for individuals who do not have a credit history, have a bad credit score, or want to avoid interest rates. With no contracts, more flexibility, and the potential to improve credit scores, it can be an excellent option for anyone looking to save money and have control over their phone ownership.

How to buy phone without credit card?

Buying a phone without a credit card isn’t impossible, but it might require some flexibility in your approach. Here are some options to consider, depending on your specific situation:

Financing without a credit card:

Debit Card EMI: Many online retailers and platforms like Amazon offer EMI (Equated Monthly Installment) plans that can be paid through your debit card. Check if your bank permits debit card EMI and what their terms and conditions are.

Consumer Durable Loans: Some banks offer special loans for buying durable goods like phones. This option might require good credit history and involve higher interest rates compared to other choices.

Buy Now Pay Later (BNPL) services: Popular services like Klarna and Affirm allow you to split your purchase into smaller, interest-free payments over time. However, late payments might incur fees, and some retailers might not offer BNPL as a payment option.

EMI cards: Certain retailers offer their own branded EMI cards, which act like pre-approved loan instruments for purchases within their stores. Check the eligibility criteria and interest rates associated with these cards.

Alternative purchase methods:

Cash payment: This is the simplest option, but it requires having the full amount upfront. Some local phone stores or sellers might offer discounts for cash purchases.

Trade-in your old phone: Many retailers offer trade-in programs where you can get a credit or discount towards a new phone by giving them your old device. This can significantly reduce the upfront cost.

Prepaid plans: Consider buying a phone bundled with a prepaid plan. This option involves paying for a certain amount of talk time, text, and data upfront, and then recharging as needed. Prepaid plans often come with budget-friendly phones.

Borrow from friends or family: This option could be helpful if you need the phone urgently and can’t wait to save up or qualify for financing. Make sure you have a clear agreement regarding repayment terms and responsibilities.

Read more: How to recharge my mobile through Al-Rajhi

Additional tips about How to buy phone without credit card ?

- Do your research: Compare prices and financing options across different retailers and platforms before making a decision.

- Consider the total cost: Look beyond the monthly EMI or installment amount and factor in any interest charges, processing fees, or other hidden costs associated with financing options.

- Budget responsibly: Ensure you can comfortably afford the phone payments without straining your finances.

- Read the fine print: Carefully review all terms and conditions before signing up for any financing or payment plan.

- Remember, the best option for you will depend on your budget, creditworthiness, and individual needs. Consider all your options and choose the one that allows you to buy the phone you need without taking on unnecessary financial risks.

Benefits of buy phone without credit card

There are several benefits of buy phone without credit card, such as:

- Flexibility: Buying a phone without a credit card gives users the flexibility to choose the phone they want and pay for it on their own terms.

- No contracts: When someone buys a phone without a credit card, they are not tied to any contract, making it easy for them to switch phone carriers or sell their phone whenever they want.

- Improves credit score: If someone chooses to buy a phone outright and make payments on time, it can help to improve their credit score. This can open up opportunities for them to get approved for other loans or credit cards in the future.

- Cost-efficient: Buying a phone outright can save someone money in the long run as they can avoid interest rates, hidden fees, and monthly contracts.

Defects of buy phone without credit card

Buy phone without credit card can be feasible, there are potential drawbacks to consider:

- Security concerns: Sharing financial information for alternative financing methods might carry some security risks compared to using a credit card with fraud protection features.

- Temptation to overspend: Without the structured payment system of credit cards, there’s a higher risk of overspending on phone purchases, especially with cash readily available.

- Potential for scams: Scammers might target individuals seeking alternative phone purchase methods, so be cautious of deals that seem too good to be true.

- Larger upfront payment: If you choose cash purchase or trade-in, you’ll need to have the full amount or a significant portion of the phone’s cost readily available. This can strain your budget, especially for high-end phones.

- Limited phone choices: Budget constraints from cash purchases or trade-in values might restrict your phone options to lower-priced models with potentially fewer features or older technology.

- Limited options: Without credit card access, you might have fewer financing choices compared to credit card holders. Options like credit card EMI or store cards might be unavailable.

Read more: How to find iPhone backup location

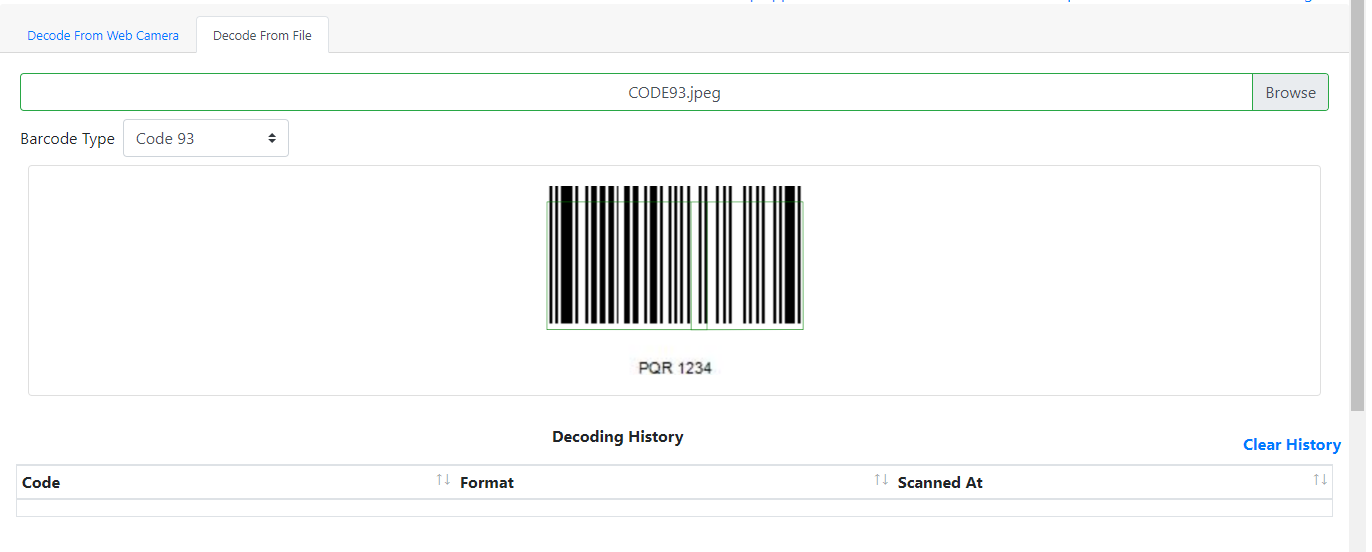

How to buy phone without credit card through ZestMoney EMI?

1- To buy phone without credit card you should register for a ZestMoney credit limit, the process is straightforward. All you have to do is confirm your mobile number and you are ready to proceed.

2- To activate your credit limit, you need to finish filling out your profile, provide the necessary KYC documents, and establish a repayment plan. By including your Aadhar card details in your KYC documents, you can qualify for a mobile EMI option.

3- Choose your preferred partner to purchase a phone. Use your ZestMoney credit limit on various platforms including Amazon, Flipkart, Mi, and over 1000 other merchant partners.

4- Select the most suitable EMI plan by choosing ZestMoney EMI as your payment method with our preferred partner. You have the flexibility to pick the EMI plan that works best for you.

5- Congratulations, your EMI application has been accepted. Your EMI installment plan has been approved and your order will be placed without any issues. The partner will follow their delivery policy and ship the product to your designated address.

Benefits of buy phone with ZestMoney EMI

Purchasing a phone on Easy Monthly Installments (EMI) offers several benefits. In the following paragraph, we will discuss the advantages of this option for financing mobile phones.

- Affordable Option: Buying a phone upfront can disrupt your monthly budget and leave you lacking funds for emergencies. However, by opting for debit card EMI or credit card EMI, you can ensure that you always have enough savings. Whether you’re searching for budget-friendly phones under Rs. 10,000 or more expensive models, you can easily make your mobile purchase.

- Monthly installments: The more advanced a smartphone’s features are, the more expensive it tends to be. However, if you choose to make monthly installments, you don’t have to pay the entire price at once, allowing you to buy your preferred phone without upfront payment.

- Save extra money: You can save extra money when purchasing mobile phones through flexible monthly installments. This allows you to pay for your phone in smaller, more manageable payments. Additionally, you can earn interest in your bank account on the money that you saved from not paying for the phone all at once.

The standards we use to determine if you qualify for a loan to purchase a mobile phone through installments.

If you want to get a personal loan from money view to purchase a mobile phone, you must meet the eligibility requirements mentioned beneath.

Loan Eligibility Criteria to Buy Mobile on EMI

- To be eligible, your age must fall within the range of 21 years to 57 years.

- Your income must be Rs. 13,500 or more.

- The applicants’ bank account should receive the income directly.

- To qualify, your credit score needs to meet a minimum requirement of 650 on either CIBIL or Experian